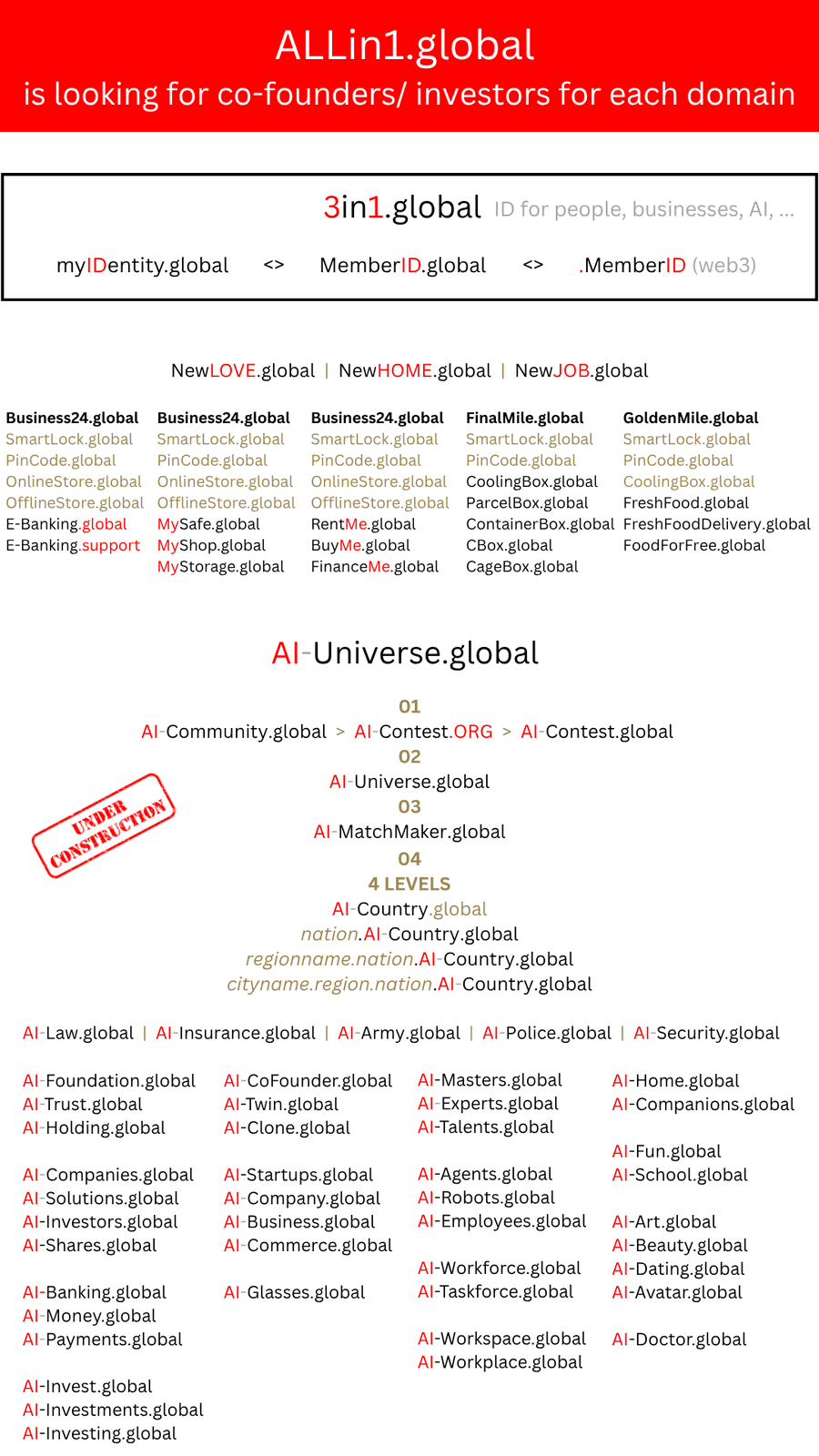

Let's Make "Everything" Investable

Let's Make "Everything" Investable

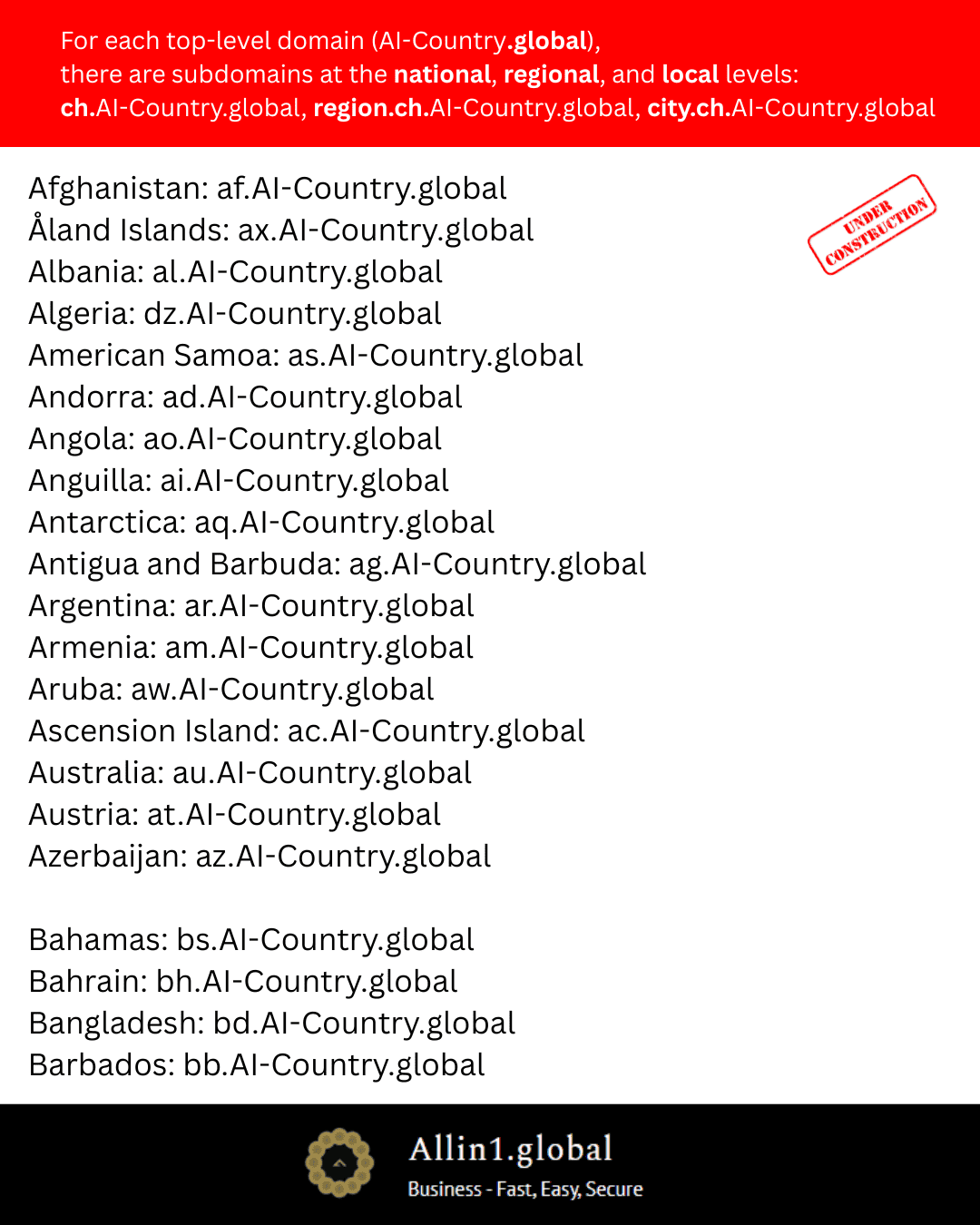

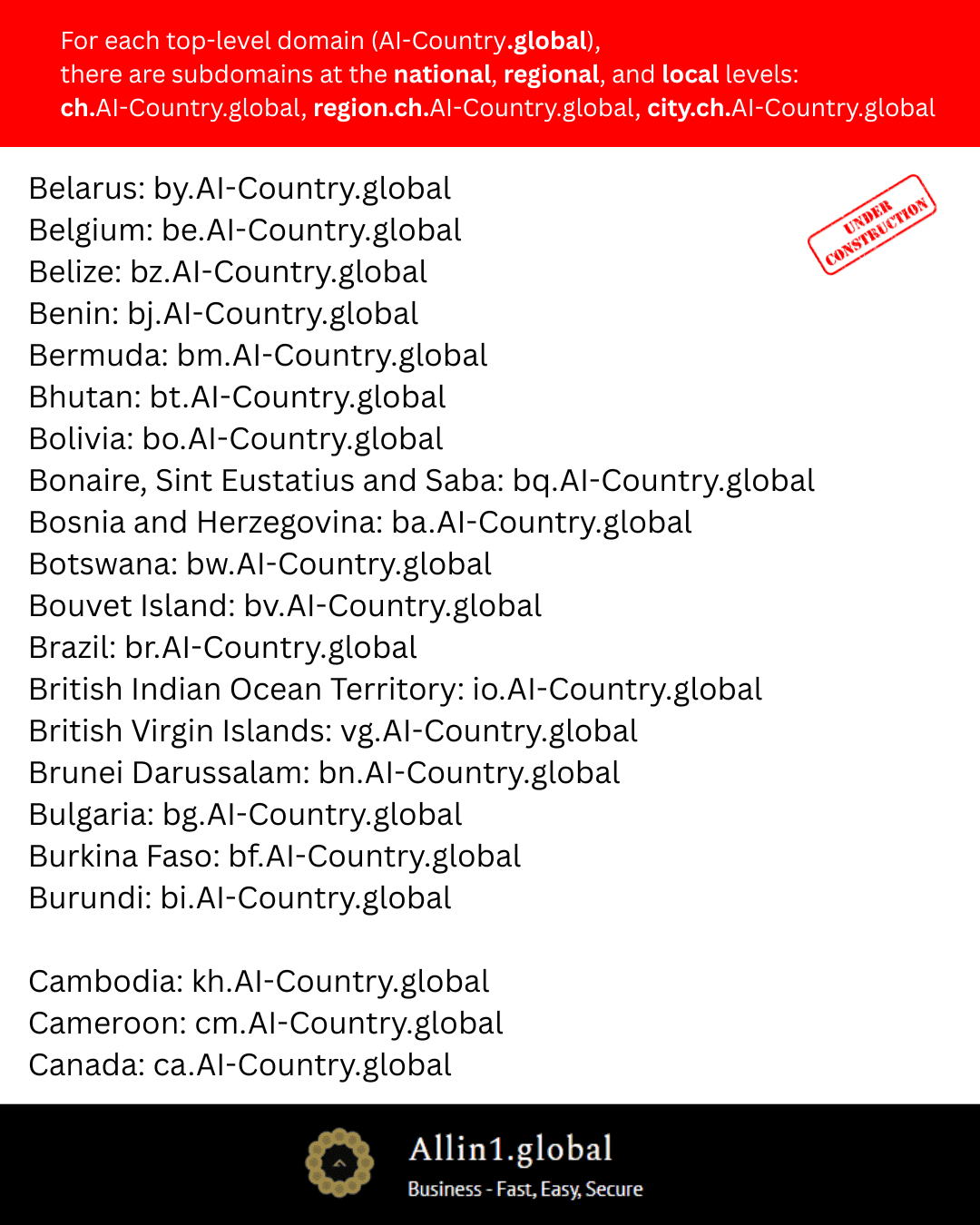

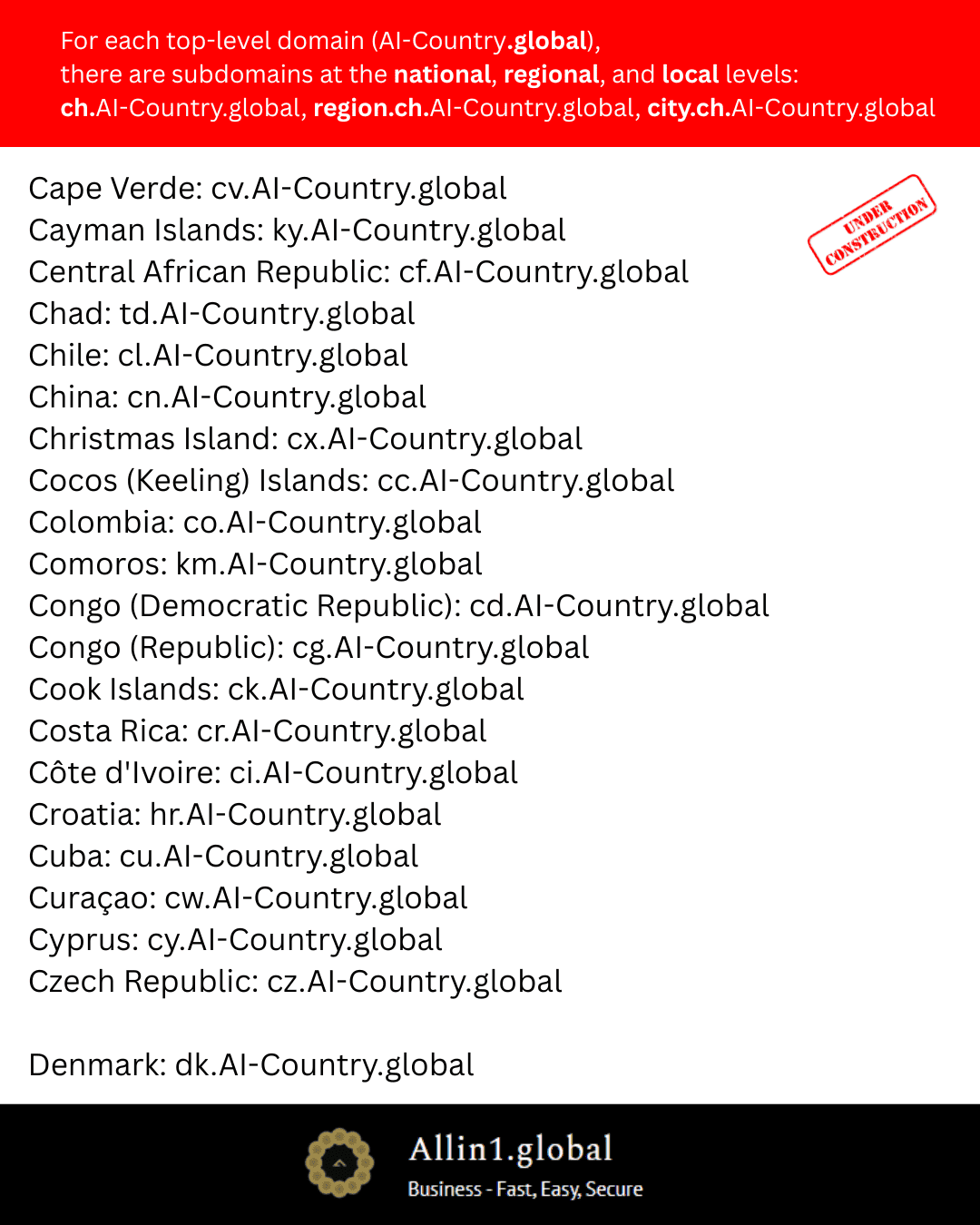

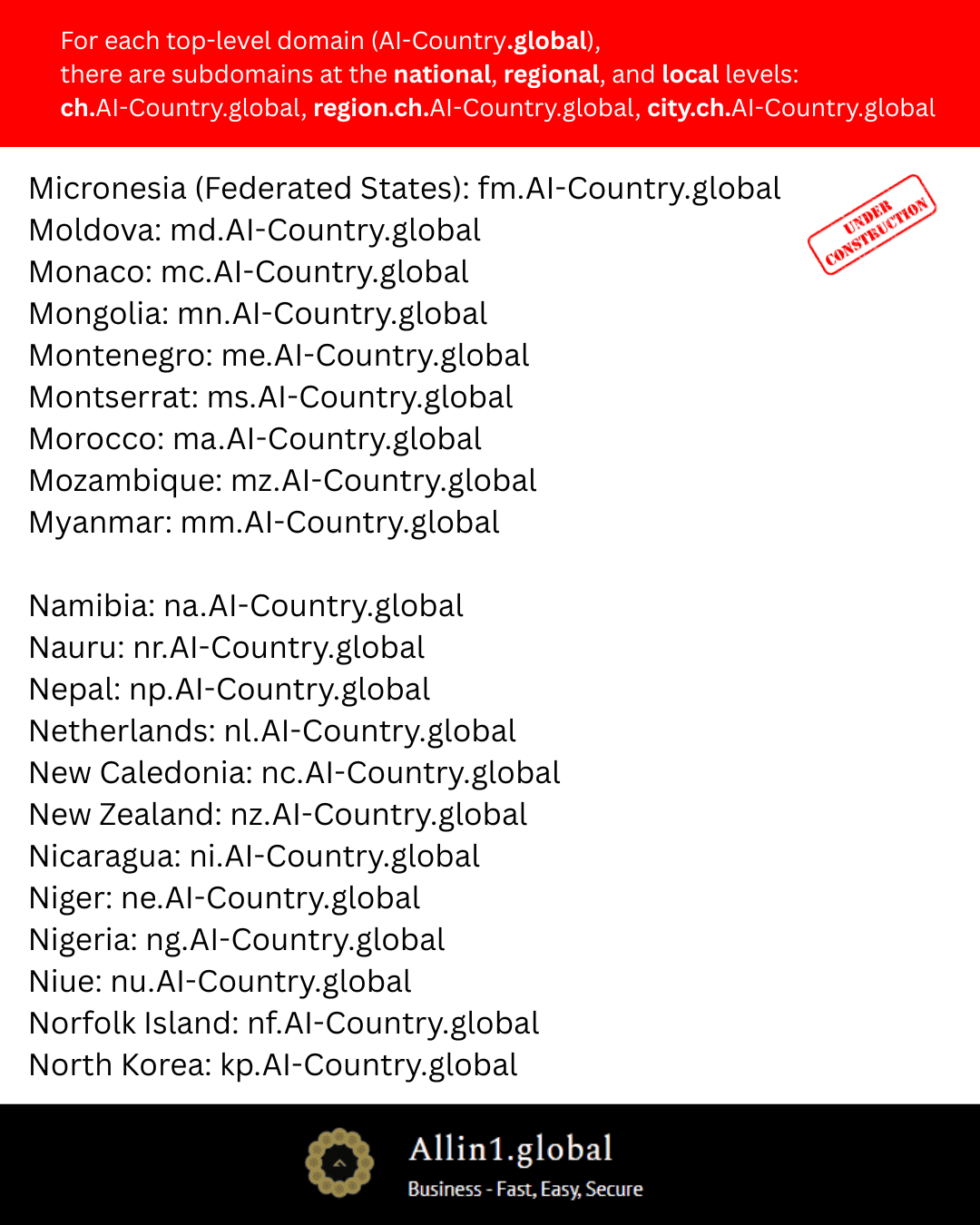

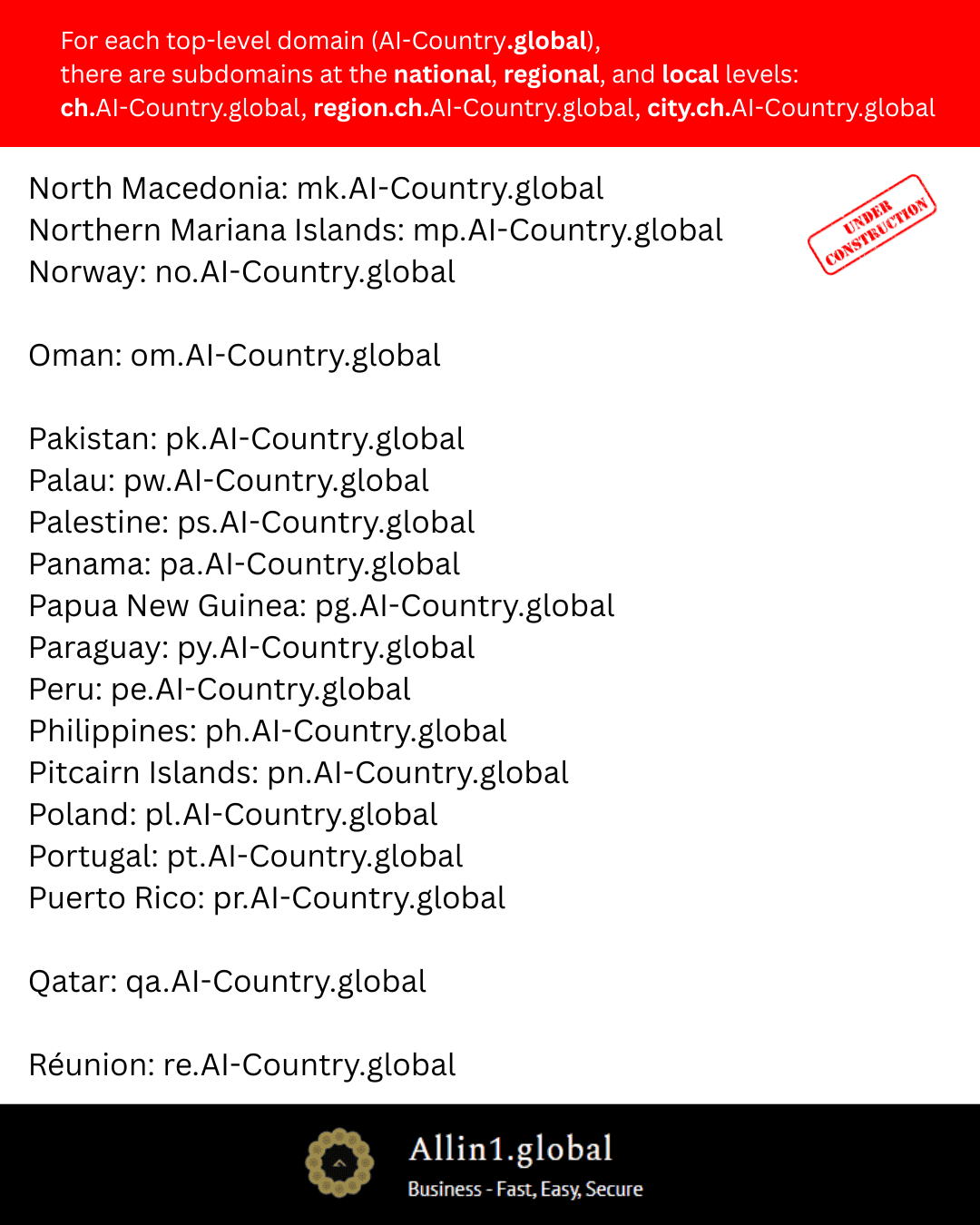

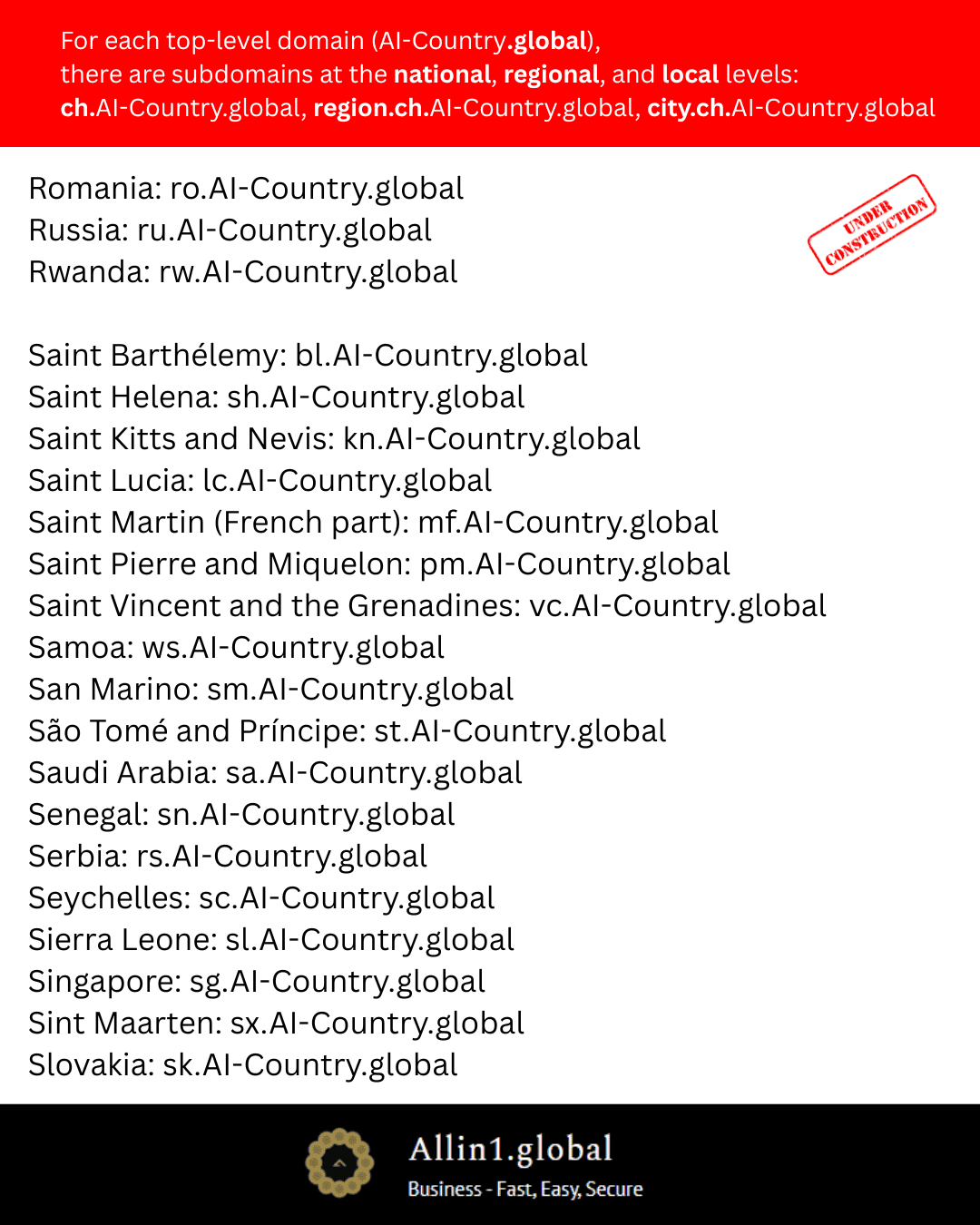

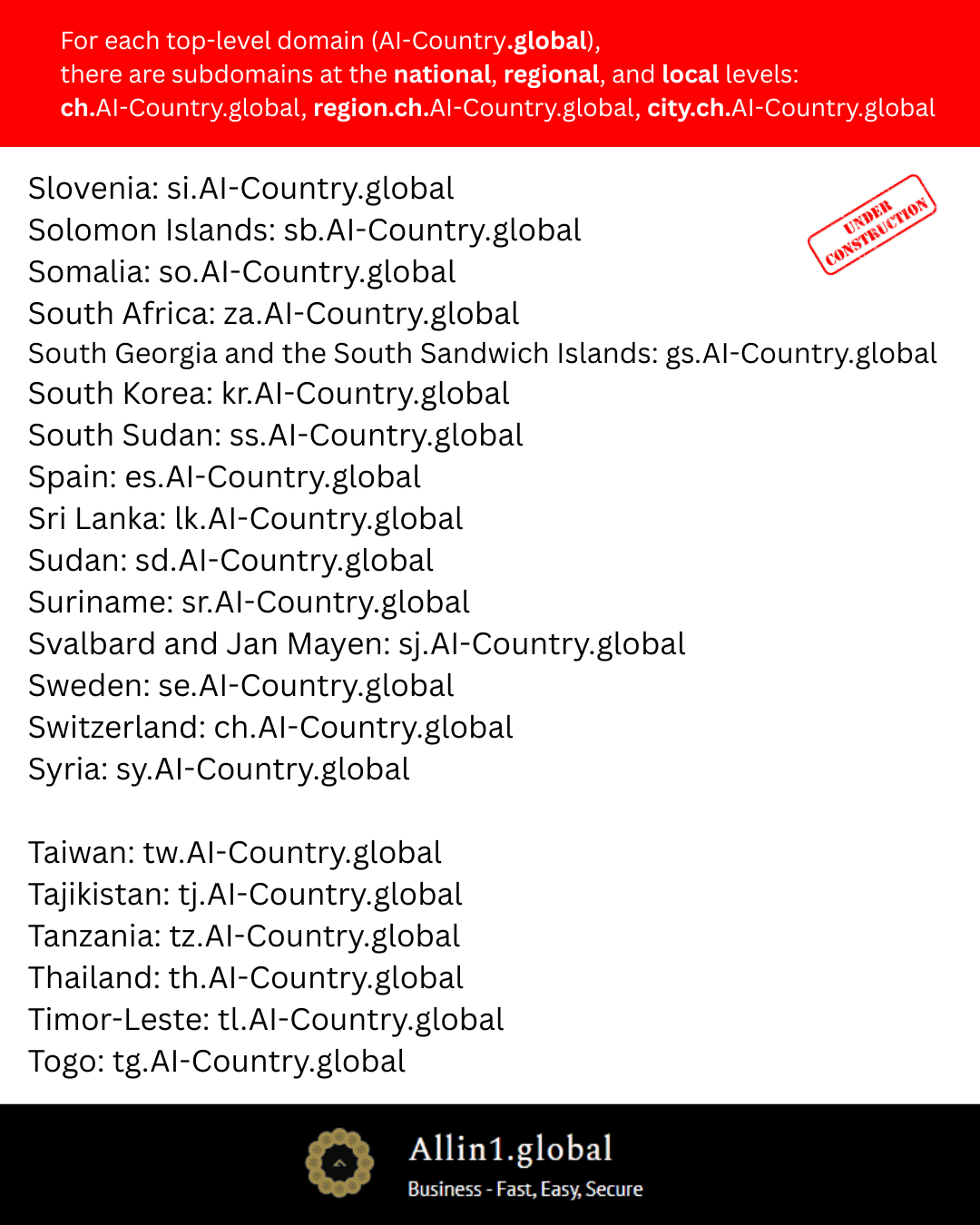

Everything on this website is under construction. We still have a lot to do.

No (AI) companies (LLCs, C-Corps in Delaware USA) have been founded yet.

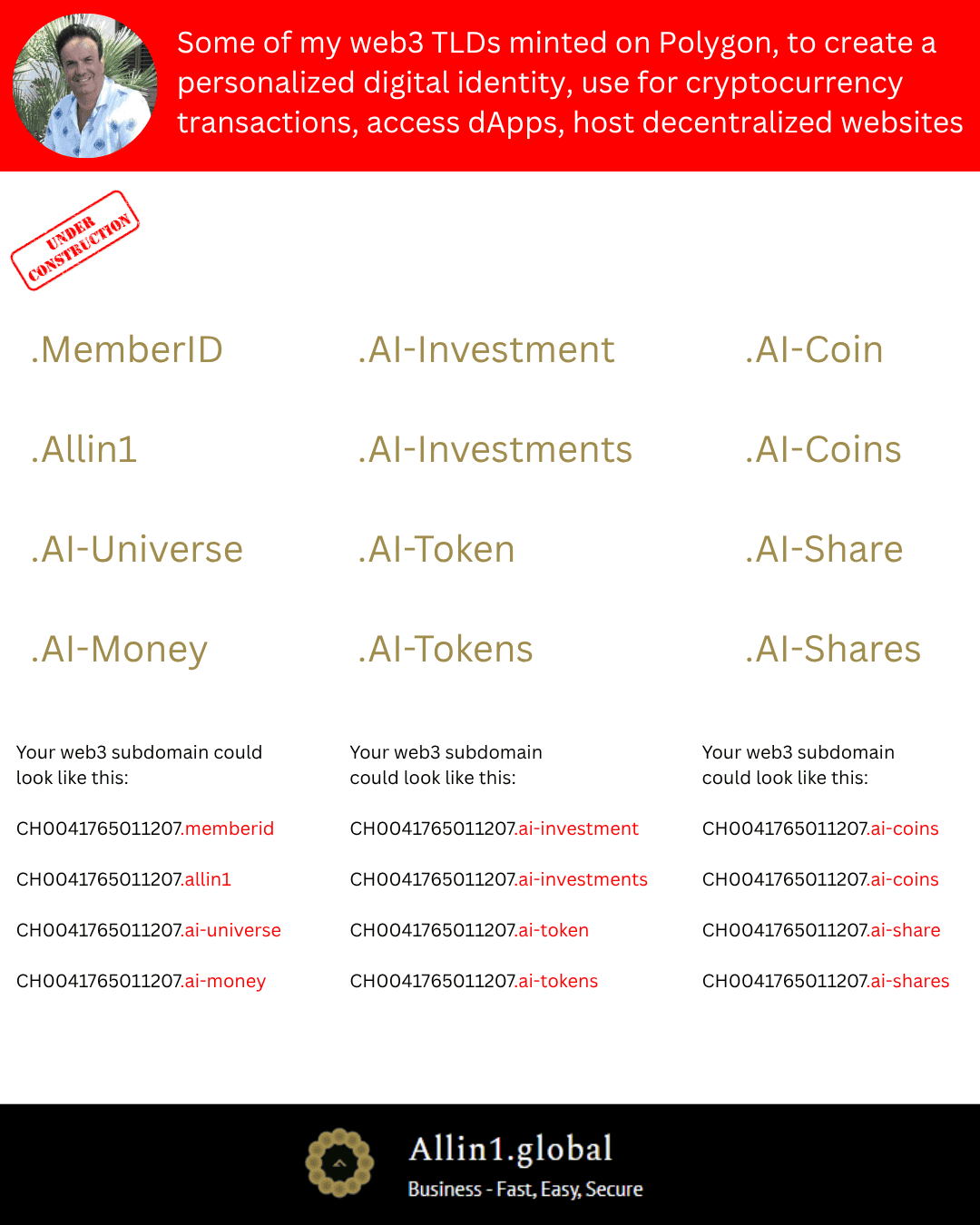

tokens, wallets, smartcontracts, blockchains

to make almost everything investable

(real estate, artwork, stocks, SHARES,

equities, bonds, debts, gold,

Real World Asset Tokenization

is a Multi-Step Process

Digital asset tokenization is the process

whereby ownership rights of an asset

are represented as digital tokens

and stored on a blockchain.

In such cases, tokens can act like

digital certificates of ownership that can

represent almost any object of value,

including physical, digital, fungible,

and non-fungible assets.

The process involves creating the

tokenomics for the selected asset type,

building smart contracts to issue the tokens,

and establishing the dedicated framework

to operate and trade the tokenized assets.

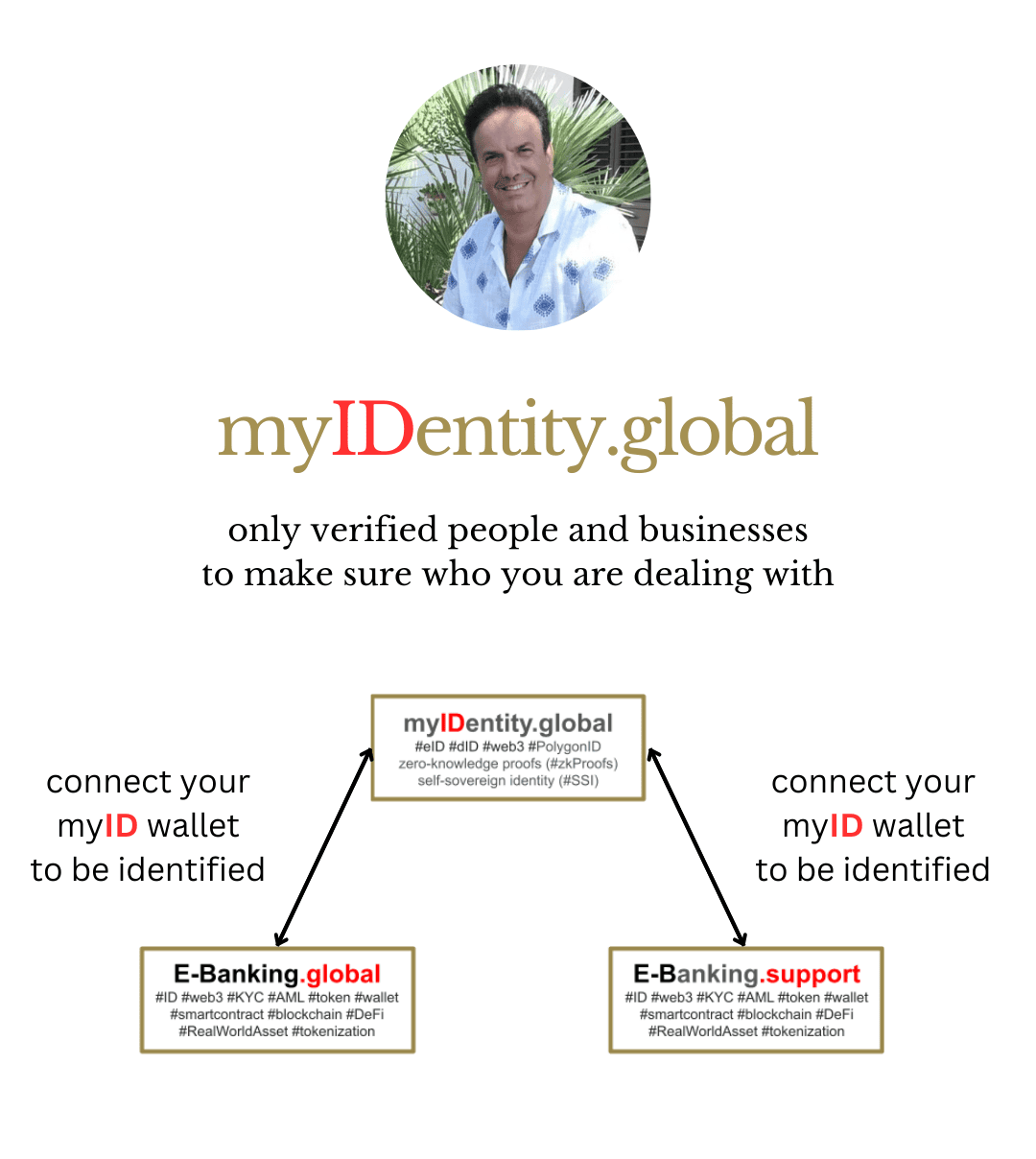

NO Digital Identity

NO Business

NO Digital Identity